Example: Trading $VRA with $100 USDT and up to 25x Leverage

Leverage trading can feel like rocket science when you’re starting out—but don’t worry. In this beginner-friendly guide, we’ll break down how leverage trading works, walk you through a realistic example using KuCoin Futures, and show the risks and rewards of trading with borrowed funds.

Important Note: This guide is for educational purposes only. It is not financial advice. Leverage trading is risky and not suitable for all investors. You are responsible for your own decisions.

What is Leverage Trading?

Leverage trading lets you borrow funds to increase the size of your trade. Think of it like using a magnifying glass—your gains and your losses get bigger.

On KuCoin Futures, you can choose leverage from 1x up to 100x, depending on the coin. In our example, we’ll use 25x leverage, which is on the higher end and not recommended for beginners.

Meet the Example:

- Coin: $VRA (Verasity)

- Capital: $100 USDT

- Leverage: 25x

- Platform: KuCoin Futures

- Trade Type: Long (you bet the price will go up)

Step-by-Step: How to Open a Leveraged Long Position on KuCoin

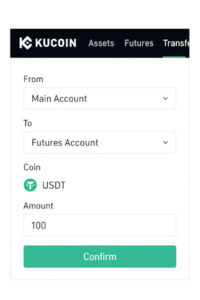

✅ Step 1: Transfer Funds to Futures Wallet

Before you can trade, move your $100 USDT from your Main Wallet or Trading Wallet to your Futures Wallet.

- Go to Assets > Futures > Transfer

- Move $100 USDT into the USDT-M Futures section.

Note – these screenshots are exemplary only!

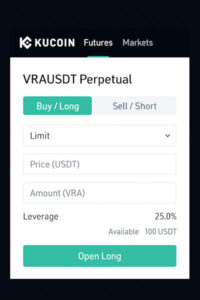

✅ Step 2: Search for VRA/USDT Perpetual Contract

- Open the KuCoin app or website

- Go to Futures and search for VRAUSDTM

If it doesn’t exist, note that not all small-cap coins have Futures contracts. You may need to simulate this example using a similar coin that supports leverage.

✅ Step 3: Select Leverage

- Tap on the Leverage Icon

- Choose 25x (NOTE: For learning purposes only; a safer number for beginners is 3x–5x)

KuCoin lets you pick different leverage amounts for isolated vs. cross margin. We’ll use isolated to limit our loss to just this $100.

Cross Margin, on the other hand, uses your entire Futures wallet balance to maintain a position, which can lead to larger losses if the trade goes against you.

✅ Step 4: Place the Long Order

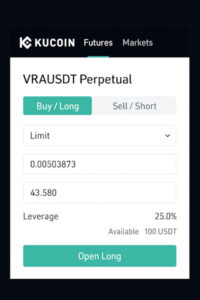

Let’s say $VRA is currently trading at $0.0050.

With 25x leverage, your $100 becomes:

- $100 × 25 = $2,500 of buying power

So you can control:

- 500,000 VRA tokens ($2,500 ÷ $0.0050)

To place the order:

- Choose Buy/Long

- Enter 500,000 VRA

- Set the price or choose Market Order to buy immediately

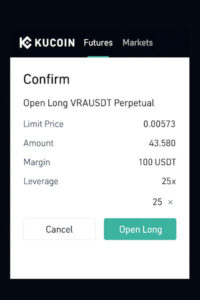

- Click Confirm

Congrats! You now hold a long position worth $2,500 with only $100 of your own capital.

What Happens Next?

Let’s look at two scenarios: one with gains, one with losses.

📈 Scenario 1: Price Increases by 4%

- New price: $0.0052

- Value of your position: 500,000 × 0.0052 = $2,600

- Profit: $2,600 – $2,500 = $100

- Return on your $100: 100% gain

You just doubled your money with only a 4% move in the underlying asset. This is the power of leverage.

📉 Scenario 2: Price Decreases by 4%

- New price: $0.0048

- Value: 500,000 × 0.0048 = $2,400

- Loss: $100

Because your initial margin was only $100, a 4% drop liquidates your position.

Liquidation: This means the platform forcefully closes your position to protect against deeper losses. You lose your entire $100.

Understanding Liquidation Price

Your liquidation price is the price at which your loss equals your initial margin.

In our case:

- Entry price: $0.0050

- Leverage: 25x

- Liquidation price: approximately $0.0048

The higher the leverage, the closer your liquidation price is to your entry. That’s why using lower leverage gives more breathing room.

Risk vs. Reward of Leverage Trading

| Pros | Cons | |

|---|---|---|

| 🚀 | Higher profit potential with smaller capital | ❗️Higher risk of losing entire capital |

| 💸 | Ability to trade more volatile assets | 💀 Liquidation risk on small price swings |

| 🔄 | Opportunity to trade long or short | 🧠 Requires constant monitoring and emotional control |

| 🔧 | Isolated margin protects other funds | 🧮 Complicated fees, funding rates, and mechanics |

Pro Tips for Beginners

- Start with low leverage (2x–5x max)

- Use isolated margin to contain risk

- Set stop-loss orders to auto-close losing positions

- Watch the funding rate—you may pay (or receive) periodic fees

- Never invest more than you can afford to lose

What If You Want to Short Instead?

If you believe $VRA will drop in price, you can open a Short position.

Just like going Long:

- Select Sell/Short instead of Buy/Long

- If VRA falls by 4%, and you’re Short with 25x leverage, you could double your $100

- But if it goes up by 4%, you’re liquidated

Shorting is powerful, but risky. Treat it with caution.

Should You Use Leverage at All?

Ask yourself:

- Can I handle losing 100% of this trade?

- Do I understand how liquidation works?

- Am I emotionally prepared for sudden swings?

If you’re unsure, try paper trading first (using demo funds), or start with 1x–2x leverage to get the feel for it.

Final Thoughts

Leverage trading on KuCoin can be a powerful tool—but it’s a double-edged sword. With just $100, you can control thousands of dollars in crypto. But with that power comes increased risk. One wrong move, and your capital is gone.

Use leverage responsibly. Never trade out of boredom or FOMO. And always remember…

⚠️ DISCLAIMER – READ THIS CAREFULLY

This blog post is not financial advice (NFA). Leverage trading involves significant risk and is not suitable for everyone. Always do your own research (DYOR), and only trade with funds you can afford to lose. Past performance is not indicative of future results.